Will SDN and its accompaniments (NFV/NV) bring back the glorious days prior to the telecom bust, and pull the networking industry out of its technological plateau? I presume, most would say that the wave has already started. It is surmised that SDN has brought back venture money to networking after years of drought, years that were mostly sustained by bigwigs of the industry, through spin-ins and strategic investments in startups. SDN has found huge favor with VCs, with startups in this space having raised nearly $500M in 2013. Successful exits in the last couple of years, including Nicira Networks (VMWare), Contrail Systems (Juniper), Vyatta (Brocade), Tail-f (Cisco), Xpliant (Cavium) and Cyan (IPO), have further spurred VC funding in the SDN market.

I will explore the SDN market landscape in this post, having covered technical aspects in my previous post.

What business potential does SDN hold?

To start off with vendor perspective, there are 2 facets to be understood –

- How will SDN impact customer spending in existing market?

- What is SDN’s potential for new market creation?

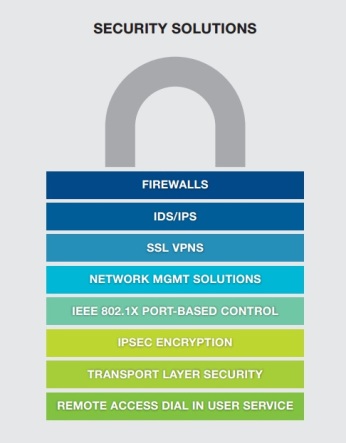

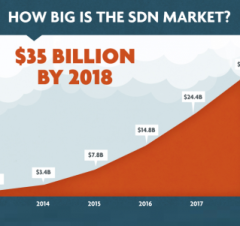

Roughly 30% of the total networking spend from Service Providers, Enterprises and Web Hosting companies is expected to be related to SDN. So, existing market players need to buckle up and be ready with committed SDN roadmaps and solutions, to still be relevant in the SDN driven networking market, as the technology is emerging as a significant influencer in network purchasing decisions. Customers are increasingly seen to evaluate how solutions and equipment procured today will fit into an SDN environment in the future. Market research firms (and VC firm Lightspeed Venture Partners) forecast impact of SDN to exceed $25B per annum, which could potentially be as high as $35B, by 2018. In comparison, the overall networking TAM is estimated to grow from the current value of $75B to $90B by 2018.

Figure – SDN existing market impact (Source: Plexxi)

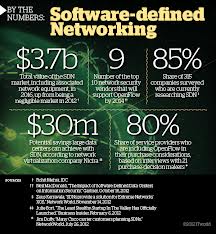

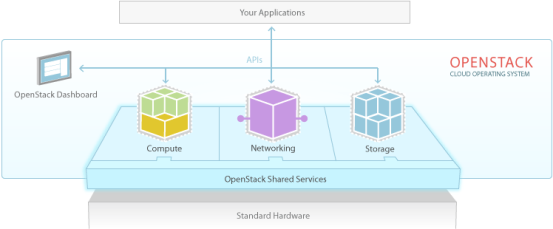

Except for speeds and feeds, networking innovation has been lagging behind compute (servers) and storage, the other two key blocks in any data center infrastructure. The advent of SDN/NFV/NV should help effectively virtualize any IT infrastructure environment by complementing compute and storage solutions, and propel new market creation, at a pace faster than seen with server virtualization in the mid-2000s. According to IDC, the new SDN market TAM will reach a total value of $3.7B by 2016, and touch $8B by 2018.

Figure – SDN new market potential (Source: IDC, Image Source: IT World)

Moving on to customer perspective, SDN assures businesses outcomes of better revenues (by enabling network monetization through improved service velocity), and lower TCO (through automated control and higher network resource utilization). As with any emerging technology, customers are apprehensive whether SDN can deliver on its promises, and are unsure of its potential to become mainstream. Broad incumbent support for SDN and significant open community efforts are expected to accelerate maturation of SDN technology, and help realize usecases.

While SDN related needs have mostly been latent, Google (a founding member of ONF) developed an in-house solution for its inter-datacenter WAN deployment with centralized traffic engineering, using OpenFlow based SDN, as early as 2012. Other marquee SDN adopters include Amazon, eBay, Rackspace and Baidu.

What are the leading usecases?

Key usecases for SDN include public & private cloud, WAN traffic optimization, dynamic WAN interconnects and re-routes, network virtualization, automated network management, service chaining, network analytics, automated malware quarantine, granular flow based DDoS mitigation et al. [I could plan to cover each of these in detail in some future post.]

The usecases span Data Centers, Enterprise campuses, Cloud Providers, Service Providers and even SMBs, as latter segment could amply gain from SDN’s value proposition of IT infrastructure simplicity.

It wouldn’t thus be an exaggeration to conclude that SDN is going to impact every customer segment and use case of the networking market, and thus no customer or vendor is going to be immune to SDN driven change.

The Ongoing Controller War

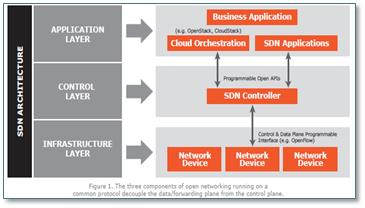

SDN has driven the emergence of a new class of products, the SDN controller. With the controller being a strategic control point of any SDN network, vendors are vying for significant mindshare of their respective SDN architecture and controller solution, to eventually translate it into a sizeable market share.

Most dominant vendors in the industry are working on their own controller offerings [Refer next section for list of SDN controllers] to better chart the course of controller evolution and development, turn on potential software differentiation and hardware-assist features, and effectively orchestrate their range of infrastructure equipment offerings.

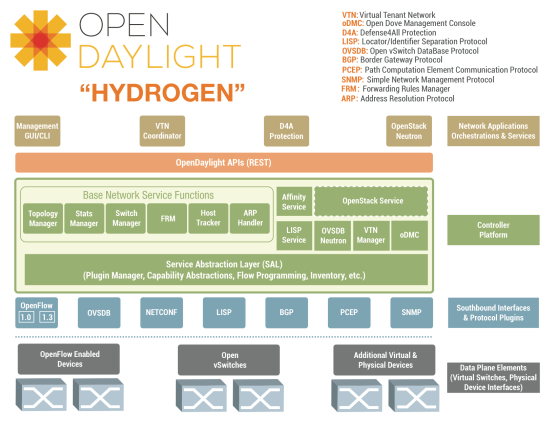

In addition, vendors (in collaboration with the Linux Foundation) have created an open-source platform for SDN, the OpenDaylight Project (ODP), to enable SDN adoption by accelerating technology development through ODP’s Open Controller.

A community-driven, common and trusted Open Controller would ensure network component interoperability across vendor offerings, both within and across architectural layers. The goal is also to promote multi-vendor environments, in comparison to today’s networks where each tier is typically populated with single vendor solutions. Network architects have been advocating open source/standard approaches to liberate customers from vendor lock-in challenges. Customers such as cloud and internet service providers, using such open standards based solutions, could still differentiate their end user offerings, by incorporating their secret sauce in the application layer. [Refer ‘SDN architecture’ section in my previous post for various layers].

Arguably, vendors who do not have their own controller but are participating actively in OpenDaylight community efforts seem to be betting the most for ODP controller to take off. Meanwhile, the controller war has heated up with the entry of other open source controllers which have been making news, namely Juniper’s OpenContrail and ON.LAB’s ONOS.

So, let us take a quick look at how these controllers differ.

ODP architecture has a single uber-controller and is primarily datacenter focused today, but could service WAN usecases as well.

ONOS targets SP WAN usecases with an architectural focus on fault-tolerance and state distribution across multiple controllers, to address high availability and bottleneck concerns with a single uber-controller. The challenge here is the need to orchestrate among these multiple controllers.

OpenContrail architecture is built for centralized control but with distributed physical components for fault tolerance. OpenContrail is very routing centric and focused on solving multi-tenant issues for SPs. Experts opine that its scope to extend to other customer segments is limited, given the lack of an abstraction layer to support multiple southbound/northbound interfaces, unlike ODP. [Refer ‘A Deep Dive into OpenDaylight components’ section in my previous post].

With vendors and communities tweaking their architectures and evolving their solutions over time, it is early to predict any potential winners. With SDN deployments being sporadic till date, it will be sometime before contenders evolve their offerings, prove their mettle in actual deployments and emerge successful.

The gamut of SDN offerings (ODP/ONF members only)

Given that there is a whirlwind of SDN activities in every nook and corner of the industry, I’ve opted to limit my evaluation to current members of ODP & ONF. To get a feel of the number of firms out there in the SDN ecosystem, refer list of players.

With SDN taking the world by storm [well, that might have be an exaggeration though – just got carried away for a bit, but here is what I wanted to say], I think it is inevitable for networking vendors to make their existing HW equipment and OS offerings SDN-ready, if they don’t want to be left behind. Also, a new group of players have emerged with niche SDN applications and orchestration platforms (e.g. PLUMGrid with its OpenStack Networking Suite).

While adding SDN capability to (legacy/existing) equipment and appliances would ensure investment protection for customers, SDN and orchestration applications (which are still taking shape and quite customer/segment specific) are key to delivering real customer value through SDN. However, adoption of SDN controllers, the pivotal component in the SDN architecture, is a precursor for customers to tap into potential of SDN applications.

I’ve chosen to focus my analysis in this post, on SDN offerings from (1) those who’ve taken the plunge by putting out (or working on) SDN controllers in the market, and (2) those who have built pure software switches, that can go with generic (x86?) hardware, towards realizing the joint vision of SDN/NFV/NV.

And, here we go with the list of SDN offerings!

(1) SDN Controller Platforms

Just a quick reminder that SDN controllers are only software platforms. And, yes, they do need a host to run on. [Would welcome inputs on hosts you’ve seen being used in SDN deployments.]

I’ve removed the term ‘Controller’ from product names in the below table. Thought it was understood.

(2) SDN Packet Processing Platforms

Here is the list of software-based SDN packet processing platforms, built to run on generic hardware. These would technically fall under the gamut of SDN-ready NFV products, though they align with SDN vision.

6WindGate 6WindGate |

Fast Path Accelerator |

Switch Light |

Vyatta 5400/5600 vRouter Vyatta 5400/5600 vRouter |

Cisco vPE-F Cisco vPE-F |

Hyper-V vSwitch Hyper-V vSwitch |

MidoNet |

ProgrammableFlow vSwitch |

Integrated Open vSwitch |

Interestingly, the ecosystem has also seen the entry of Intel into Ethernet switch market, with FM5000/FM6000 series of SDN-enabled ASICs.

Commercial SDN deployments

Now, let me run SDN through the market adoption test!

As we saw, there is no dearth of SDN offerings in the market. But, but, has SDN really taken off? I chose to evaluate this based on public customer references. I thought I’d be amply surprised if any vendor deployed SDN commercially and didn’t get their marketing folks to put together public customer references, or if carriers/web hosting companies didn’t want to make a splash of having adopted SDN. And well, I was surprised. Anyways, more on this later.

Going based on public references, here are the commercial SDN deployments of vendors. I’ve kept out in-house SDN solutions developed/deployed by customers such as Google, NTT, AT&T, Amazon, Microsoft, Facebook, given the number of makeshift offerings masquerading themselves as SDN solutions, and the many paths to realizing SDN benefits of programmability and improved service velocity.

| SDN Vendors | Customers | Deployment Usecases |

|

SP Carrier Network | |

|

Private Cloud | |

| Data Centers | ||

| Cloud Data Centers | ||

|

Cloud Data Centers | |

|

|

Data Centers (Prior to VMWare acquisition) |

|

Data Centers (Prior to VMWare acquisition) |

Additionally, Cyan reports on its website that Blue Planet SDN platform has been implemented in 120 production networks, but I didn’t come across any other public material.

Seems too short a list right? Either these are the only commercial deployments or public references aren’t the way to go. Didn’t think that SDN customers (and not just startups like Versa Networks, GuardiCore) would be in stealth mode. If you know of any more SDN deployments, please point me to public references online.

If you could spare time for a deep-dive, do take a look at the links I’ve embedded (at the start of this section) on in-house SDN solutions being worked on by SDN “customers”. Interesting to see how boundaries are continuing to blur across vendors and customers!

May the best win (or atleast each find their niche) and the ecosystem prosper!

That was quite a long post! I really hope to limit the post length in future.

Meanwhile, if you have any feedback on this one, please post a comment or drop an email. I’m certain there’d be alternate views, especially given the murky state of the SDN market.